Спрос надетали щековой дробилкипродолжает расти, поскольку все больше людей полагаются на карьерные работы, переработку и экспорт.щековая дробилкарынок растет наболее 10%каждый год, показывая сильную потребность вдетали дробилки. Компании теперь сосредотачиваются на улучшениищековая дробилкапроекты и экологически чистые решения, позволяющие оставаться впереди.

Ключевые выводы

- Theдетали щековой дробилкиРынок быстро растет из-за роста объемов строительства, добычи полезных ископаемых и переработки по всему миру.

- Новые технологиитакие как автоматизация, интеллектуальные датчики и более качественные материалы, делают дробилки более эффективными, долговечными и экологичными.

- Лидером роста рынка является Азиатско-Тихоокеанский регион, в то время как Северная Америка и Европа сохраняют сильные позиции; переработка и устойчивое развитие стимулируют будущий спрос.

Обзор рынка запчастей для щековых дробилок

Прогнозы роста на 2025 год

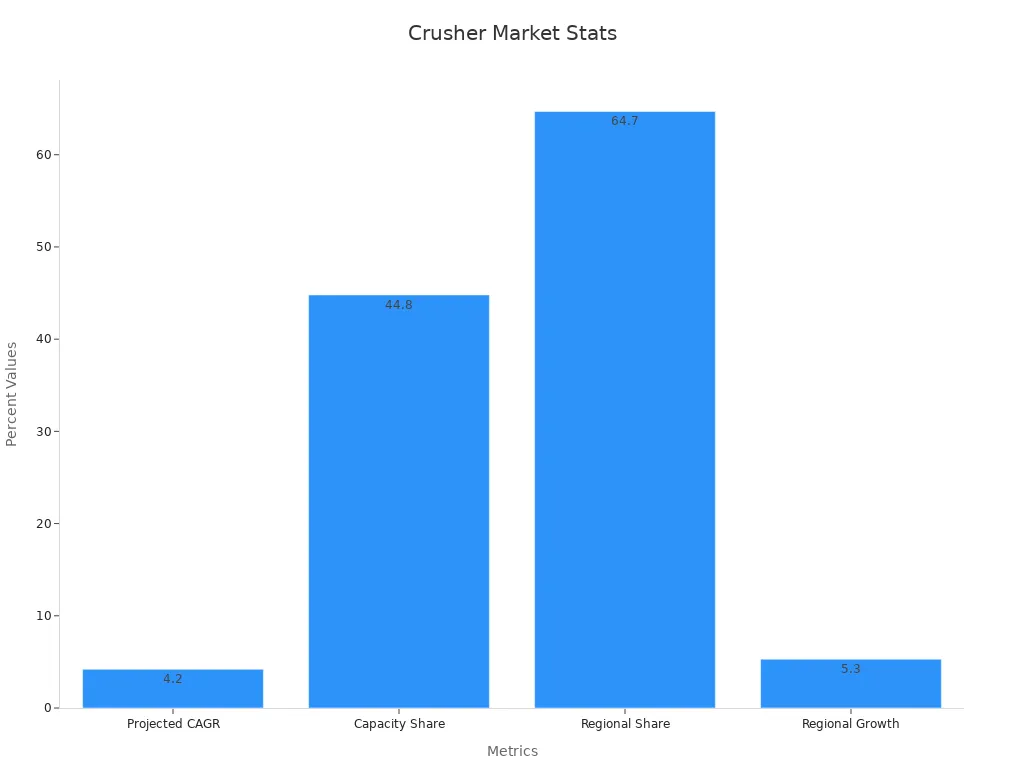

Рынок щековых дробилок растёт с каждым годом. В 2024 годуразмер рынка достиг 4,82 млрд долларовЭксперты ожидают устойчивый рост до 2025 года, при этомПрогнозируемый совокупный среднегодовой темп роста составит 5,2% в период с 2026 по 2033 год.Этот рост обусловлен увеличением числа строительных и горнодобывающих проектов по всему миру. Компании также инвестируют вновые технологииЧтобы дробилки работали эффективнее и прослужили дольше. В таблице ниже представлены некоторые важные тенденции, формирующие рынок:

| Аспект | Подробности |

|---|---|

| Рыночная оценка (2024) | 2,8 млрд долларов США |

| Прогнозируемый среднегодовой темп роста (2025-2034) | 4,2% |

| Ключевые драйверы рынка | Развитие инфраструктуры, расширение горнодобывающей промышленности,технологические достижения (IoT, ИИ, автоматизация) |

| Технологические тенденции | Интеллектуальное оборудование, предиктивное обслуживание, эксплуатационная эффективность |

| Экологический фокус | Экологичные, энергоэффективные, электрические и гибридные дробилки |

| Доминирующий сегмент типа (2024) | Дробилки с одной щекой |

| Самый большой сегмент емкости | 100–300 тонн в час (44,8% доли рынка) |

| Проблемы рынка | Высокие капитальные и эксплуатационные затраты |

Ключевые секторы, стимулирующие спрос

Горнодобывающая промышленность и строительство лидируют в использованиидетали щековой дробилки. Ожидается, что к 2030 году объем добычи полезных ископаемых достигнет 15,27 млрд долларов США., демонстрируя устойчивый рост почти на 10% в год. Щековые дробилки играют важную роль в дроблении горных пород и материалов для этих отраслей. Урбанизация и новые инфраструктурные проекты, особенно в Азиатско-Тихоокеанском регионе, ещё больше повышают спрос. Также растёт спрос на переработку отходов, поскольку всё больше компаний ищут способы повторного использования материалов и сокращения отходов.

Вы знали?Щековые дробилки занимают более 38% рынка оборудования для дробления камня., показывая, насколько они важны в горнодобывающей промышленности и строительстве.

Региональные горячие точки

Азиатско-Тихоокеанский регион выделяется как самый быстрорастущий регион в сфере поставок деталей для щековых дробилок. Китай и Индия инвестируют огромные средства в строительство дорог, мостов и зданий. Северная Америка также занимает значительную долю рынка, при этом на долю США приходится почти 65% регионального рынка. Ближний Восток и Африка также демонстрируют высокие темпы роста благодаря новым горнодобывающим и инфраструктурным проектам. На диаграмме ниже представлены доли рынка и темпы роста по регионам:

Факторы, влияющие на спрос на запчасти для щековых дробилок

Инфраструктура и урбанизация

Города продолжают расти, и каждый год появляются новые дороги, мосты и здания. Стремительная урбанизация диктует необходимость использования прочных строительных материалов. Щебень служит основой для многих из этих проектов, а щековые дробилки помогают дробить горные породы на пригодные для использования фрагменты. По мере того, как всё больше людей переезжают в города, растёт спрос на новые дома, офисы и общественные пространства. Правительства также инвестируют в «умные» города и улучшение инфраструктуры, что означает увеличение объёмов работ для строительного сектора.

- К 2025 году мировые расходы на инфраструктуру превысят 9 триллионов долларов.

- Развивающиеся страны, особенно в Азии, тратят почти половину этой суммы.

- В 2023 году по всему миру стартовало более 5000 новых инфраструктурных проектов.

- Только для программы строительства автомагистралей в Индии ежегодно требуется 3 миллиона тонн щебня.

Примечание: Мобильные и передвижные дробилки становятся все более популярными, поскольку их можно легко перемещать между городскими и удаленными объектами.

В таблице ниже показано, как различные секторы и регионы влияют на спрос на детали для щековых дробилок:

| Фактор спроса / Статистика | Данные/Описание |

|---|---|

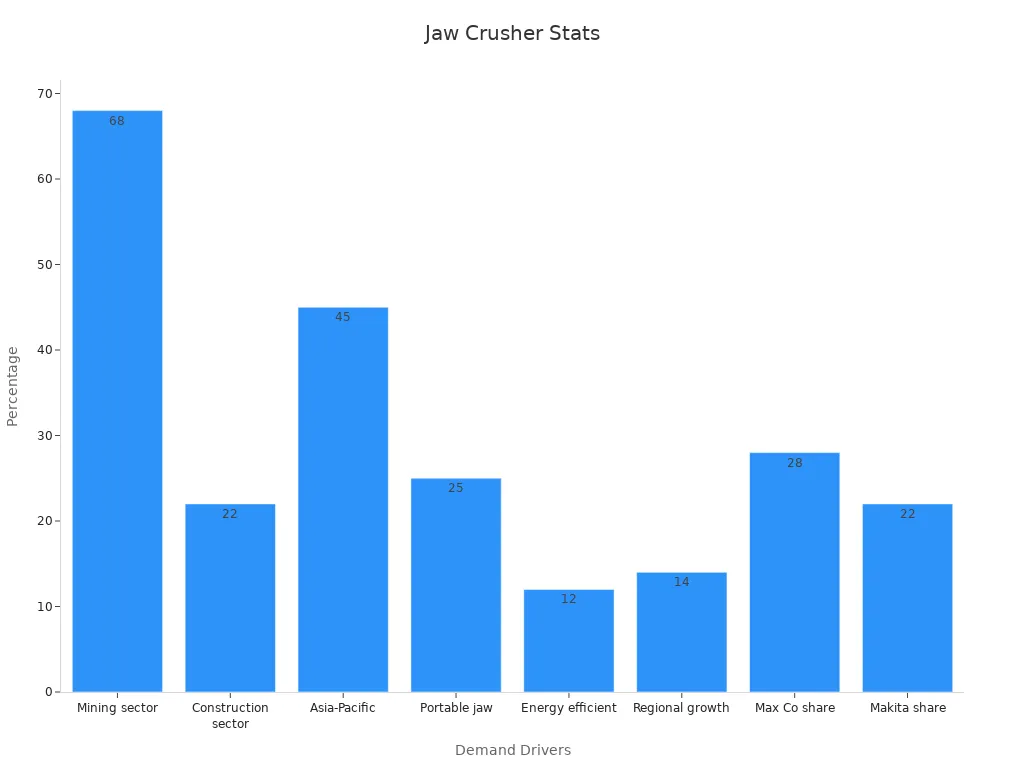

| Доля спроса в горнодобывающем секторе | Примерно 68% от общего спроса на щековые дробилки в 2024 году |

| Доля спроса в строительном секторе | Около 22% спроса на рынке щековых дробилок в 2024 году |

| Доля рынка Азиатско-Тихоокеанского региона | Более 45% мировых поставок щековых дробилок в 2024 году |

| Доля переносных щековых дробилок | Около 25% поставок нового оборудования в мире |

| Инфраструктурные проекты | Более 5000 новых проектов по всему миру в 2023 году |

| Инвестиции в НИОКР (2023) | Более 1,2 млрд долларов инвестировано в инновационные технологии дробления |

| Примеры регионального роста | На Ближнем Востоке и в Африке количество установок новых дробилок увеличилось на 14%. |

| Энергоэффективные дробилки | В 2024 году на электроагрегаты пришлось 12% продаж нового оборудования. |

| Доля лидеров рынка | Доля Max Co на рынке составляет 28%; доля Makita на рынке — 22% в 2024 году. |

Расширение сектора переработки отходов

Переработка — это не просто тренд, это необходимость. Многие страны сейчас сосредоточены на повторном использовании материалов из старых зданий, дорог и мостов. Щековые дробилки играют ключевую роль в этом процессе. Они измельчают бетон, асфальт и другие отходы, чтобы эти материалы можно было использовать повторно. Это помогает сократить количество отходов и сэкономить деньги.

- Япония и Южная Корея лидируют в переработке отходов, используя дробилки для переработки материалов для новых проектов.

- Страны Персидского залива инвестируют в возобновляемые источники энергии и инфраструктуру, что увеличивает потребность в дробилках для переработки переработанных материалов.

- Щековые дробилки необходимы для первичного дробления., что делает их незаменимыми для центров переработки.

Поскольку все больше компаний переходят на методы циклической экономики, спрос надетали щековой дробилкирастёт. Эти машины должны работать усердно и часто нуждаются в новых деталях для бесперебойной работы.

Рост промышленного экспорта

Обменщековая дробилкапродолжает расти.Северная Америка выступает лидером по экспорту современных щековых дробилок.Такие компании, как Metso Outotec, Sandvik AB и Terex Corporation, разрабатывают машины с интеллектуальными функциями, такими как диагностика на основе Интернета вещей и искусственного интеллекта. Благодаря этим функциям их дробилки пользуются популярностью на рынках Латинской Америки, Азиатско-Тихоокеанского региона и Ближнего Востока.

Соединенные Штаты играют большую роль в мировой торговле дробилками,обработка около 7% всех импортных поставокЛидером рынка является Индия, занимающая более половины рынка, а в Перу также наблюдается высокий спрос. Экспортеры видят большие возможности в этих быстрорастущих регионах.

Совет: щековые дробилки экспортного класса часто характеризуются мобильностью и энергоэффективностью, что привлекает покупателей, для которых важны экологичность и возможность переработки на месте.

Растущий спрос со стороны строительства, горнодобывающей промышленности и переработки отходов, а также государственные расходы и новые экологические нормы поддерживают экспортный рынок. Эта тенденция приводит к увеличению спроса на запчасти для щековых дробилок по всему миру.

Технологические достижения в запчастях для щековых дробилок

Автоматизация и интеллектуальные функции

Автоматизация изменила подход компаний к использованию щековых дробилок. Сегодня многие машины оснащены интеллектуальными функциями, которые помогают операторам управлять ими и контролировать их работу дистанционно. Эти функции упрощают отслеживание производительности и раннее выявление проблем. Операторы могут регулировать настройки, проверять степень износа и даже запускать или останавливать машину с помощью планшета или телефона.

- Мониторинг в режиме реального времени позволяет командам видеть, как работает дробилка каждую минуту.

- Благодаря дистанционному управлению операторам не нужно стоять рядом с шумными машинами.

- Автоматизированные системы регулируют скорость подачи и параметры дробления для достижения наилучших результатов.

Умные функции не просто облегчают жизнь. Они также повышают эффективность. Автоматизированные системы регулировки могутповысить эффективность работы на 20%Производительность может увеличиться на 22%, поскольку машина адаптируется к изменениям свойств материала. Потребление энергии снижается примерно на 15%, что экономит деньги и способствует сохранению окружающей среды. Расходы на техническое обслуживание снижаются до 30%, поскольку система может сама смазывать детали и предупреждать об их износе. Эти улучшения приводят к уменьшению количества поломок и увеличению рабочего времени.

Совет: компании, использующие автоматизацию и интеллектуальные функции, часто отмечают сокращение простоев и повышение производительности.

Вот таблица, показывающая некоторые изпоследние технологические достиженияи их влияние:

| Технологический прогресс | Описание | Влияние на рынок запчастей для щековых дробилок |

|---|---|---|

| ИИ, автоматизация и машины с ПЛК-управлением | Машины используют ИИ и ПЛК для точного и гибкого управления. | Более высокая эффективность, более высокое качество и экономия энергии. |

| Гибридные и электрические приводы | Дизель-электрические и гибридные приводы снижают выбросы и потребление энергии. | Поддерживает устойчивость и рост рынка. |

| Передовые сенсорные системы и видеотехнологии | Датчики и камеры контролируют работу дробилок в режиме реального времени. | Меньше простоев, больше производительности и надежности. |

| Улучшенный поток материала и высокая производительность | Увеличенные раскрытия щек и улучшенная конструкция потока повышают производительность. | Более высокая производительность, больший спрос на современные детали. |

| Износостойкие материалы и умные вкладыши | Новые материалы и подкладки на основе технологий Интернета вещей отслеживают износ и служат дольше. | Более длительный срок службы деталей, более простое обслуживание, расширение рынка. |

Инновации в материалах и дизайне

Изменения в материалах и конструкции сделали щековые дробилки прочнее и надёжнее. Производители теперь используют специальные сплавы, которые долговечны и устойчивы к износу. Например, некоторые компании используют смесь марганцевой стали с карбидом хрома. Эта смесь делает детали почти вдвое прочнее обычной стали. Эти новые материалы могут…детали служат на 30–60 % дольше.

Конструкция также имеет значение. Более простая конструкция с меньшим количеством движущихся частей снижает вероятность поломки. Более лёгкие детали облегчают перемещение и установку дробилки. Регулируемые параметры разгрузки позволяют операторам выбирать размер измельчаемого материала. Более агрессивные удары дробления позволяют пропускать больше материала через машину, что повышает эффективность.

Вот некоторыеключевые показатели дизайна и материалов:

| Метрика / Характеристика | Описание/Преимущество |

|---|---|

| Коэффициент уменьшения | Контролирует размер и качество продукции, помогает экономить деньги. |

| Более простой дизайн | Меньше деталей, проще ремонтировать, ниже затраты. |

| Меньший вес | Легче перемещать и устанавливать, экономит время и деньги. |

| Регулируемый сброс | Позволяет пользователям выбирать размер измельчаемого материала. |

| Более высокая пропускная способность | Перемещает больше материала, повышает эффективность. |

| Расходы на техническое обслуживание | Ниже за счет более качественных материалов и простой конструкции. |

Цифровые инструментыТакже это помогает. Операторы могут использовать данные и аналитику в режиме реального времени для корректировки настроек и обеспечения бесперебойной работы дробилки. Это означает меньший износ, большую производительность и меньшее энергопотребление.

Примечание:Аддитивное производство, или 3D-печать, начинает использоваться для изготовления индивидуальных вкладышей для дробилок. Это позволяет компаниям создавать детали, точно соответствующие их потребностям.

ИИ и предиктивное обслуживание

Искусственный интеллект (ИИ) существенно влияет на то, как компании заботятся о своих щековых дробилках.Системы искусственного интеллекта анализируют данные с датчиков, чтобы предсказать, когда деталь может выйти из строяЭто помогает командам устранять проблемы до того, как они приведут к поломке. Прогностическое обслуживание может сократить время простоя до 30% и уменьшить количество внеплановых остановок на 40%.

ИИ не просто выявляет проблемы. Он учится на прошлых данных, чтобы лучше прогнозировать будущие. Некоторое программное обеспечение даже позволяет командам общаться с системой на естественном языке, что упрощает планирование ремонтных работ. Например, Bayer CropScience использует инструменты ИИ для улучшения планирования технического обслуживания и сокращения незапланированных простоев.

- Системы на базе искусственного интеллекта помогают командам действовать быстро и поддерживать работоспособность машин.

- Автоматизированный сбор данных гарантирует, что в системе всегда будет актуальная информация.

- Прогностическое обслуживание продлевает срок службыдетали щековой дробилкии снижает затраты.

Современные щековые дробилки часто имеют модульную конструкцию и развитую автоматику.Эти функции повышают надежность оборудования и упрощают его обслуживание. Компании, использующие искусственный интеллект и предиктивное обслуживание, отмечают меньше поломок, более длительный срок службы деталей и более высокую производительность.

Вы знали?Умные лайнерыБлагодаря интеграции с Интернетом вещей можно отправлять оповещения о необходимости замены, поэтому операторы никогда не пропустят период технического обслуживания.

Тенденции устойчивого развития в области запасных частей для щековых дробилок

Экологичные материалы и конструкции

Производители теперь сосредоточены на производстве дробилок, которые помогают планете. Они используют новые материалы иумные проектыдля сокращения отходов и экономии энергии. Многие компании начали использовать электрические или гибридные источники энергии. Этот переход помогает сократить загрязнение окружающей среды и расходы на топливо. Вот некоторые тенденции, определяющие развитие отрасли:

- Более 60% новых дробилок в 2023 годуиспользована электрическая или гибридная энергия.

- Такие компании, как Sandvik, Metso и Terex, инвестируют в исследования для создания более совершенных и экологичных машин.

- Энергоэффективная дробилка Sandvik сокращает расходы примерно на 15%.

- Гибридная дробилка Metso потребляет на 20% меньше энергии, чем старые модели.

- Умные дробилки с функциями Интернета вещей выросли на 35% за пять лет.

- Строгие правила в Европе подталкивают компании использовать экологически чистые материалы и конструкции.

- Электрические измельчители могут снизить затраты на топливо до 25%.

Эти изменения показывают, что отрасль заботится как об окружающей среде, так и об экономии денег.

Энергоэффективность и сокращение выбросов

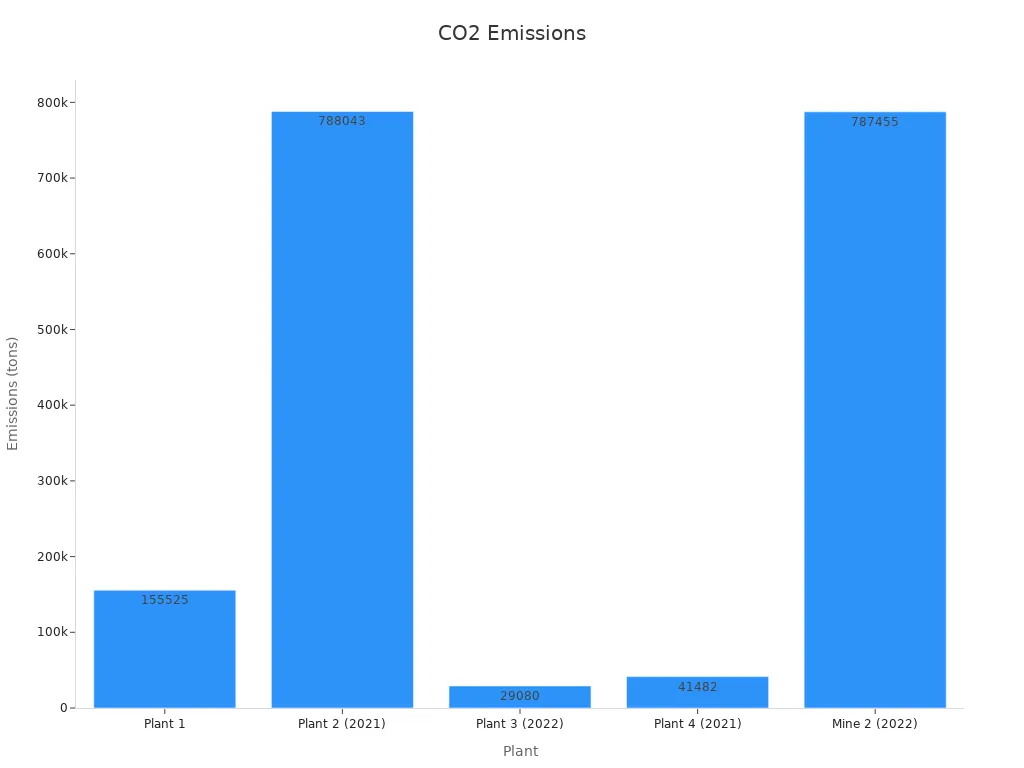

Потребление энергии и выбросы важны как никогда. Заводы, потребляющие меньше энергии и производящие меньше выбросов, помогают защитить окружающую среду. В таблице ниже показано, как различные заводы управляют потреблением энергии и выбросами:

| Завод / Шахта | Индекс энергоемкости (ГДж/тонну) | Общие выбросы CO2 (тонны) | Ключевые наблюдения |

|---|---|---|---|

| Завод 1 | ЭII-Au ↓ 12% | 155,525 | Хороший контроль энергопотребления, меньшие выбросы |

| Завод 2 | ЭII-Au ↓ 25%, ЭII-Cu ↓ 37% | 788,043 | Высокое потребление энергии, рост выбросов |

| Завод 3 | ЭII-Au ↑ 88% | 29,080 | Стабильные выбросы, возможности для улучшения |

| Растение 4 | ЭII-Au ↑ 2842% | 41,482 | Высокая энергия и выбросы |

Заводы, использующие электроэнергию и интеллектуальные системы, могут снизить выбросы и сэкономить энергию. Измельчение потребляет больше всего энергии, поэтому новые технологии помогают сократить количество отходов. Компании также используют углеродные кредиты для инвестиций в более экологичное оборудование.

Циклическая экономика и управление жизненным циклом

В отрасли теперь заботятся о полном сроке службы каждой детали. Компании перерабатывают старые детали и используют материалы с увеличенным сроком службы. Они проектируют дробилки, чтобы рабочие могли легко заменять детали, что означает меньше отходов. Умные датчики отслеживают необходимость замены деталей, поэтому ничто не выбрасывается преждевременно. Такой подход способствует развитию экономики замкнутого цикла, где ресурсы используются многократно.

Примечание: Когда компании концентрируются на управлении жизненным циклом, они одновременно экономят деньги и помогают планете.

Инвестиционные возможности и проблемы рынка

Регионы и сектора с высоким ростом

Инвесторы видят большие возможности в регионах, где бурно развивается строительство и горнодобывающая промышленность. Северная Америка выделяется своей сильнойинфраструктурные проекты и передовые технологииМестные компании используют системы искусственного интеллекта и электропривода, чтобы сделать дробилки более интеллектуальными и экологичными. Азиатско-Тихоокеанский регион, особенно Китай и Индия, быстро растёт благодаря строительству новых дорог, зданий и заводов. Эти страны инвестируют в разведку полезных ископаемых и современное оборудование. Европа также инвестирует в строительство автомагистралей и железных дорог, а Латинская Америка и Африка демонстрируют многообещающие перспективы благодаря развитию горнодобывающей промышленности и строительства.

| Область | Драйверы роста и сектора |

|---|---|

| Северная Америка | Ведущие производители, рост строительства, НИОКР в области энергоэффективных дробилок |

| Азиатско-Тихоокеанский регион | Быстрая индустриализация, инвестиции в инфраструктуру, эксплуатация минеральных ресурсов |

| Европа | Высокие инвестиции в инфраструктуру, развитая горнодобывающая промышленность |

| Латинская Америка, Ближний Восток и Африка | Инфраструктура и добыча полезных ископаемых растут, но медленнее из-за трудовых и политических проблем |

Совет: такие секторы, как переработка отходов, производство наполнителей и металлургия, также стимулируют спрос наусовершенствованные детали дробилок.

Рыночные барьеры и ограничения

Рынок сталкивается с рядом проблем. Высокие первоначальные затраты затрудняют приобретение нового оборудования малыми компаниями. Проблемы в цепочке поставок, такие как задержки с поставкой комплектующих, могут замедлить реализацию проектов. Цены на сталь часто меняются, что затрудняет планирование бюджета. Некоторым компаниям сложно найти квалифицированных рабочих для эксплуатации и ремонта дробилок. Новые правила, регулирующие уровень шума и выбросов, означают более высокие затраты для всех. Торговые барьеры, такие как пошлины в США, повышают цены и вынуждают компании искать новых поставщиков.

- Высокие инвестиционные затраты ограничивают возможности мелких операторов.

- Задержки и нехватка ключевых деталей увеличивают затраты.

- Колебание цен на сталь влияет на планирование.

- Нехватка квалифицированной рабочей силы сокращает использование машин.

- Более строгие экологические правила увеличивают расходы.

- Тарифы и изменения в торговле нарушают цепочки поставок.

Стратегические подходы к выходу на рынок

Компании используют разумные стратегии, чтобы добиться успеха на этом рынке. Многиеинвестировать в исследования по созданию дробилок с гибридной мощностью и цифровыми функциямиПартнёрство с горнодобывающими и строительными компаниями помогает им охватить больше клиентов. Выход на быстрорастущие регионы, такие как Азиатско-Тихоокеанский регион и Латинская Америка, снижает риски и увеличивает продажи. Клиентоориентированные услуги, такие как обучение и послепродажная поддержка, укрепляют лояльность. Некоторые компании используют прямые продажи, в то время как другие работают с дистрибьюторами или продают онлайн, чтобы охватить больше покупателей. Ориентация на устойчивое развитие и новые технологии даёт компаниям преимущество перед конкурентами.

Примечание: компании, которые планируют риски в цепочке поставок и инвестируют в цифровые инструменты, часто остаются впереди на меняющемся рынке.

Региональные данные о запчастях для щековых дробилок

Ведущие рынки: Северная Америка, Европа, Азиатско-Тихоокеанский регион

Лидерами являются Северная Америка, Европа и Азиатско-Тихоокеанский регионв отрасли щековых дробилок. У каждого региона есть свои сильные стороны и причины роста. Северная Америка выделяется как лидер рынка. Компании из США и Канады концентрируются на новых технологиях и повышении производительности дробилок. Европа занимает вторую по величине долю рынка. Германия лидирует по продажам, а Великобритания растёт быстрее всего. Спрос в этом регионе обусловлен сферой недвижимости и крупными строительными проектами. Азиатско-Тихоокеанский регион растёт быстрее всех. Китай занимает наибольшую долю рынка, а Индия быстро догоняет. Многим заводам и шахтам в этих странах необходимы мощные и надёжные дробилки.

Вот краткий обзор лучших регионов:

| Область | Позиция на рынке | Ключевые драйверы роста | Ведущие страны | Известные тенденции |

|---|---|---|---|---|

| Северная Америка | Лидер рынка | Технологические инновации, улучшенные характеристики дробилки | США, Канада | Фокус на производительности и интеллектуальных функциях |

| Европа | Вторая по величине доля рынка | Недвижимость, строительство, инфраструктура | Германия, Великобритания | В связи со строительными проектами и реконструкциями |

| Азиатско-Тихоокеанский регион | Самый быстрый среднегодовой темп роста (2023-2032) | Горнодобывающая промышленность, строительство, переработка отходов | Китай, Индия | Экономичные, долговечные и производительные дробилки |

Крупные компании, такие как Sandvik, Terex и Metso, инвестируют в исследования и сотрудничество с местными партнёрами. Они выпускают новые продукты и строят заводы рядом с клиентами. Это помогает им снизить затраты и охватить больше покупателей.

Развивающиеся регионы и неиспользованный потенциал

Некоторые регионы только начинают развиваться на этом рынке. Латинская Америка, Ближний Восток и Африка демонстрируют устойчивый прогресс. В этих регионах с каждым годом растёт число горнодобывающих предприятий и новых строительных проектов. Многие компании рассматривают эти регионы как новые большие возможности.

- Больший спрос на специальные щековые дробилки возникает в сфере строительства, горнодобывающей промышленности и переработки отходов.

- Города в Китае и Индии продолжают расти, а это значит, что появляется все больше дорог и зданий.

- Латинская Америка и Африка инвестируют в горнодобывающую промышленность и новую инфраструктуру.

- Переработка отходов и экологичное строительство обуславливают необходимость использования дробилок, способных перерабатывать старые материалы.

- Компании изучают отчеты и обзоры экспертов, чтобы найти лучшие точки для роста.

- Как глобальные, так и локальные бренды стараются расширить свое присутствие в этих регионах, чтобы привлечь новых покупателей.

Примечание: Поскольку все больше стран уделяют внимание переработке отходов и устойчивому развитию, потребность в измельчителях в этих регионах, вероятно, будет продолжать расти.

Рынок продолжает расти благодаря спросу в горнодобывающей промышленности, строительстве и новых технологиях. Компании видят большие возможности, но сталкиваются с такими трудностями, как нехватка сырья и строгие правила.

| Аспект | Подробности |

|---|---|

| Рыночная оценка 2024 | 1,5 миллиарда долларов США |

| Прогнозируемая оценка 2033 г. | 2,8 млрд долларов США |

| Среднегодовой темп роста (2026-2033) | 7,5% |

| Перспективы рынка | Положительный и расширяющийся |

Часто задаваемые вопросы

Для чего используются детали щековой дробилки?

Детали щековой дробилкиПомогают дробить камни и другие твёрдые материалы. Они используются в горнодобывающей промышленности, строительстве и переработке для изготовления более мелких деталей для строительства или повторного использования.

Почему растет рынок запчастей для щековых дробилок?

Всё большему числу городов нужны новые здания и дороги. Компании стремятся перерабатывать старые материалы. Эти потребности стимулируют спрос на прочные и надёжные запчасти для щековых дробилок.

Как новые технологии улучшают детали щековых дробилок?

Умные функции и лучшие материалы делаютдетали щековой дробилки служат дольше. Они также помогают машинам потреблять меньше энергии и реже нуждаться в ремонте. Это экономит деньги и время.

Post time: Jul-07-2025